Hello!

I’ve started this substack to share my value-investing ideas and valuation process - but mostly I’ve started it for myself to make sure that I’m rigorously developing my investment ideas. I hope to be able to clarify my thinking, document my valuation, and open my thesis up to constructive criticism.

Anyway - let’s get into it!

SWBI

The first stock I want to value is Smith and Wesson Brands Inc. (SWBI). Currently at $15.85 a share.

SWBI came up on my screener at Finviz.com where I cast a pretty wide net - looking for stocks with a PE < 20; P/FCF <20; ROE > 10% and ROIC > 5%; and a PEG <2 along with a few other filters making sure the debt levels aren’t too crazy and the earning are at least positive.

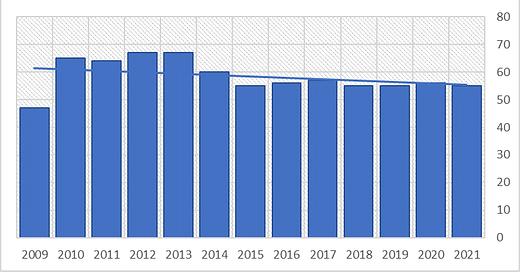

The first thing I like to look at is the outstanding shares and how that has changed. Outstanding shares has been flat/trending down which is good.

A quick look at some of the ratios (I like to use StockAnalysis.com) made me interested but wary.

PE: 3.5

P/FCF: 2.88

ROE: 79.7%

ROIC: 134.9%

Current Ratio: 3.23

Generally when the ratios look this good there’s a good reason for it. SWBI has crashed about 30% in the last six months - with a big crash just the other day when it missed earnings. So what’s up?

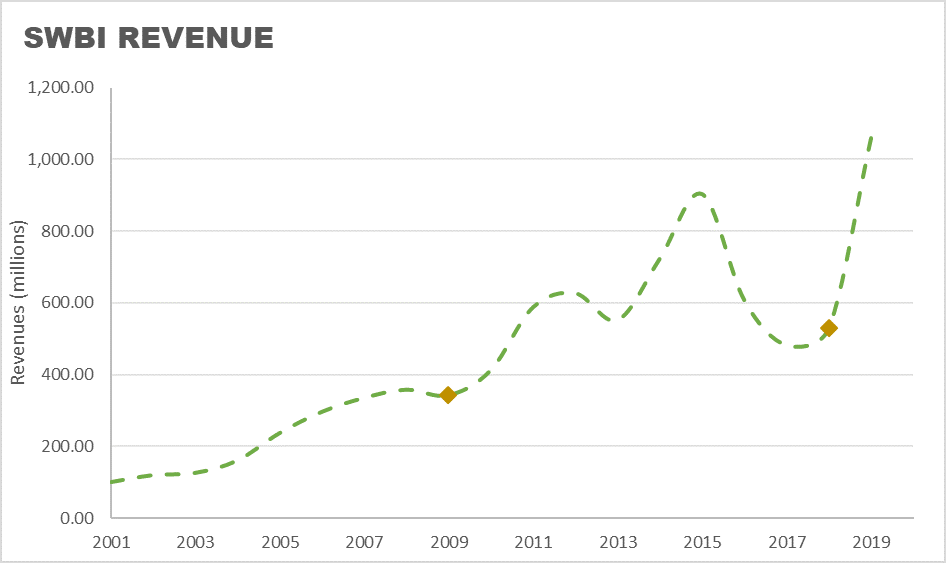

The reason is that SWBI is a very cyclical stock. You can see that growth tends to jump up and then crash down. If it’s not obvious, it seems to roughly follow the political cycle as politics (and also apparently pandemics) make people buy more guns.

And the return of this cycle is what has sent the stock crashing:

Shares of Smith & Wesson Brands (NASDAQ: SWBI) are tumbling 18.1% at 11:00 a.m. ET after the firearms manufacturer reported earnings indicating the sales surge it's enjoyed over the past few years has finally dissipated. Fiscal 2022 third-quarter net sales of $177.7 million plummeted 31%…GAAP net income was also cut in half, and adjusted earnings nearly

CEO Mark Smith said the firearms market "has cooled significantly from the height of the pandemic surge and seems to now be following pre-pandemic historical demand patterns."

Now I’m alright with a cyclical stock - the idea of value investing is that Mr. Market sometimes prices stocks irrationally high and sometimes irrationally low. A stock that jumps between those extremes seems perfect for a value investor. However, we must be very cautious not to extrapolate from the past cycle of higher earnings just as it is about to crash down. And indeed, this seems to be the reason why all the ratios look so good - growth was great, but the forward-looking market thinks the future will be quite different from the past making the ratios quite misleading. However, we can still value it if we’re careful and conservative.

Valuation

We’ll value the company with a DFC based on Aswath Damodaran’s DFC model using (my absolute favorite website) Tracktak.com.

I’ll include a link to download my DFC at the end, but first let’s go through the assumptions:

Risks

A good place to start is to look at the risks in the 10K - you can find the latest 10k for SWBI here.

Looking through the 10K, what jumps out to me are risks related to regulation and liability. Although the balance sheet looks strong, the politicized nature of the business adds some inherent risks - and here’s an interesting historical fact from wikipedia:

After an organized campaign by the NRA and NSSF over the issue of smart guns,[15] thousands of retailers and tens of thousands of firearms consumers boycotted Smith & Wesson.[16][17] CEO Ed Shultz, who negotiated the deal, was forced out in September of that year.[18] By December 2000, the company's stock price was 19 cents per share.[19] Smith & Wesson dropped its smart gun plans after nearly being driven out of business.[20]

Although the balance sheet looks strong - $446.03 (millions) in assets excluding goodwill vs $143 in total liabilities - I think the nature of the business means that we need to factor in some non-trivial probability of failure into our valuation. I’ve gone with a 4% probability of failure over the next decade and made a mental note not to let this stock become too large of a percentage of my portfolio.

Revenue - Base Year

We’re going into a down cycle - that’s obvious. The worst in the last decade had revenues down 32.89% one year, then down 20.68% the next. That is in fact the worst cycle I could find data on going all the way back to 2001. All told, revenues fell 53.29% from 903.19 in 2016 (all numbers in millions) to 481.34 in 2018.

Now to be clear, revenue has still trended up over all of these cycles. With the worst extended period I can see being from the peak of the 2011 to the depths of the down cycle in 2018 where revenue was flat/slightly down.

I think a good conservative estimate is to assume that revenues fall 53.29% (matching the greatest previous historical drop) from the current TTM revenue of 1005.97 to 469.8. That would be the lowest level since 2011 and below where revenue was at the depths of the last down cycle in 2018. So, we’ll begin our DFC will the assumption that our base year will start with revenues of $469.8.

Growth - CGAR

The tricky part of a DFC is usually the growth rate. I like to look at it from a few ways a get a conservative estimate.

looking at the graph of revenues, I think a fair range would be from 2009 to 2018. This way we’re somewhat excluding the peaks, and some of the more optimistic portions of the graph, and it is a decade-long fairly recently segment.

Using the compound annual growth rate formula between these years we calculate a growth rate of: 4.46%

There are other way of estimating growth besides looking at the historical data. Aswath Damodaran covers some of them here and I like the estimate that is based on reinvestment rate of a company and its return on investment. That methodology gives us an estimate of 9.12%

Looking at estimates for the industry, a CAGR of 6.15% is projected into the future - so it doesn’t look like a dying industry.

I’m going to go with the 4.46% number to be extremely conservative.

Operating Margin

Currently SWBI’s operating margin is ~30%. But, like revenues, this is a cyclical number. The average operating margin has been ~17% with a high of ~30% and a low of 4.46%

To be conservative, we’ll assume an operating margin from before the pandemic jump of 9.50% continues for the next decade. This might be a bit conservative but gives us some downside protection should it spend some time closer to the historic all-time low.

Sales to Capital Ratio

The average sales to capital ratio for the industry is 2.61, Currently its at 5.44, but that is much higher than usual. I’ve excluded 2021 as an outlier, and taken the average of the values from 2015 - 2020 which gives us a sales to capital ratio of: 1.5

DFC

With these assumptions we can now run a DFC to get a valuation for SWBI.

I’ve uploaded my DFC to github so you can see the calculations for yourself. With these assumptions we arrive at a Valuation of $14.26 meaning that SWBI is currently ~11% overvalued.

Below you can see a sensitivity analysis showing what the valuation would be with different values for the growth rate (CAGR) and the Operating Margin. A little bit of a higher growth rate would probably push it into fair-value territory.

Strategy

Finding a stock to be slightly overvalued is a common result for me with valuations as high as they are, and my love of conservative inputs. So, what is a good strategy for this stock? I might be interested in selling puts on it.

Looking at the options market - $15 Puts are selling for $1.53 for June 17th with a breakeven price of $13.47. What this means is that someone will pay me $153 if I promise them they’ll have the option to sell me 100 shares of SWBI on June 17th for $15 a share. If the stock crashes to $5 a share, I’ll have to pay $15 for them, when you include the $153 they paid me my breakeven would $13.47. So if it falls below that point I will have lost out. However, 13.47 is 5.5% below my valuation, I would be happy to buy it at that price.

And if the stock stays above $15, I’ve made $153 while tying up $1,500 of capital for 104 days. That’s an annualized return of 35.80%

So, selling puts seems like a reasonable option. But, with the Ukraine-Russia War, interest rate hikes, SWBI just starting a downwards cycle, and SWBI still being overvalued, I think it has room to fall. I will probably hold off and look to start selling puts if the stock drops another 10-15%.

I would love to hear your opinion of the analysis! Poke holes in it - what did I get wrong?? Let me know if there are any interesting stocks I should value - and please subscribe for future valuations :)

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this channel.

Love the analysis. I also value it around 15 a share. Optioning in is a good call, though I’d be weary getting in over 12. Just don’t think it has enough runway to be a multi bagger. Better places to place capital imo